What is the current assets formula?

Current assets are assets that can be converted into cash within one year. These include accounts receivable, inventory, and any other liquid asset. A company’s financial position is important, so current assets are a vital part of any business.

They are also used to calculate a company’s current ratio, which is often used as an indicator of how likely the company will be able to pay its short-term debts and obligations. This is relevant for local businesses because it determines the amount that is available to fund day-to-day business operations and ongoing operating expenses.

Signpost is used by thousands of service businesses to build a trusted online reputation. Let us show you how our review software works.

Types of Current Assets

There are primarily four different types of current assets that can be calculated. These include:

Cash and cash equivalents – this means anything that is easily convertible to cash, such as money in the bank or petty cash.

Short-term investments – these are investments that have a maturity period of fewer than 12 months, such as bonds or stocks.

Accounts receivable – this refers to any money owed to you by customers who have purchased your goods or services on credit.

Inventory – if you own a store, you must take into account both merchandise and raw materials available for sale. Inventory includes all products or materials your company owns but has not yet sold.

Keep reading to learn more about each of these.

Cash and Cash Equivalents

Cash and cash equivalents are highly liquid assets that can easily be converted into cash. They include cash and unencumbered financial instruments which have a maturity date of fewer than 90 days. Examples of these include:

Cash in the bank

Money market funds

Short-term treasury bills (less than 1 year)

Let’s say you own a small plumbing business, with $2,000 in your company checking account, $3,000 in your savings account and $1,500 invested short-term treasury bills. All of these are considered as cash or cash equivalents because they can be converted to cash and used to pay for current liabilities on your financial statements like your balance sheet.

The total amount of these assets adds up to $6,500 which is then entered under the “current asset” section on your balance sheet.

Accounts Receivable

Accounts receivable are your business’s claim on other businesses or individuals for goods sold or services rendered. Like cash, these accounts can be converted into cash if the customer pays his or her bill.

Accounts receivable is calculated by adding up all the balances of the outstanding invoices from your customers and should be reported in your company’s balance sheet as an asset.

An example of how to calculate accounts receivable could include an HVAC business that has three commercial businesses as clients: a movie theater, a local grocery store and a restaurant. The HVAC business has completed work for each client and sent out an invoice to receive payment.

When the company prepares its balance sheet at year-end, it would enter the amount owed by each client to calculate its total accounts receivable figure. This is how much money you can reasonably expect to receive from customers who owe you money at a certain point in time (usually year-end).

Inventory

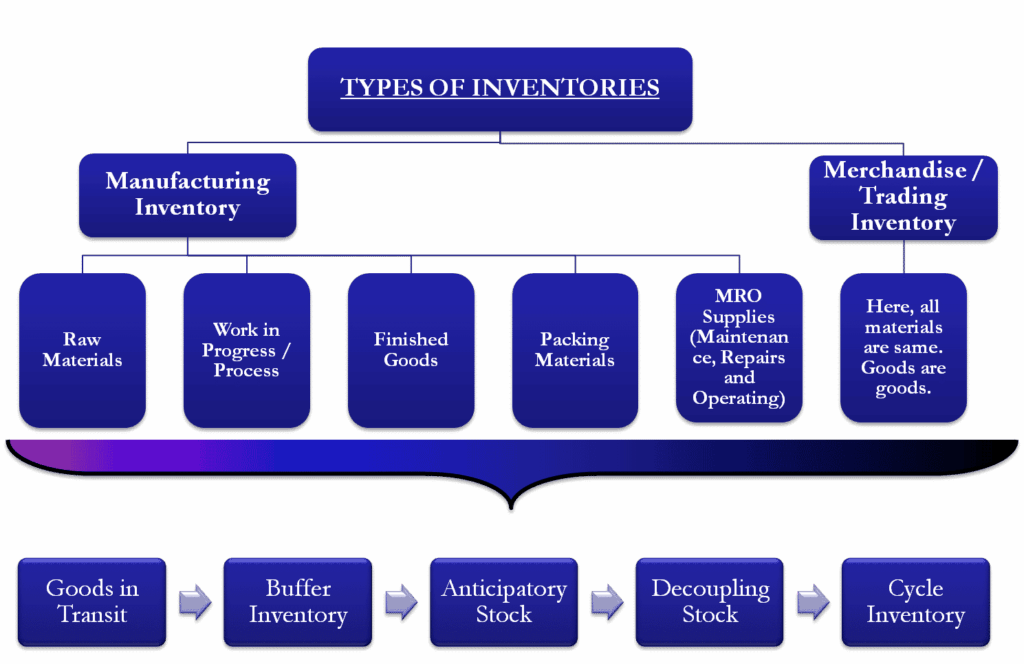

Inventory is the stock of any item or resource that a business holds in order to manufacture other products or to sell on to customers. As such, it can be broadly divided into two categories:

Inventory used to produce products: This includes the raw materials and components used in production, as well as work-in-progress and finished goods.

Inventory held for resale: This includes all finished goods that have been manufactured but not yet sold to customers. If you work at a roofing company, for example, this can include shingles that have not yet been sold. At an HVAC company, this can include filters for HVAC systems that have not been sold yet.

Source: eFinance Management

Let’s look at an example of calculating inventory for a roofing company. In this case, inventory could consist of raw materials, like wood shingles, and work in progress would be roofs/panels under construction.

Short-Term Investments

Short-term investments, or liquid securities, are financial instruments that you hold for 1 year or less. Your short-term investments can be in the form of cash, stocks, bonds or other securities.

Short-term investments are also known as marketable securities. You can also calculate your current assets by adding together all your short-term investments and subtracting any purchased shares that have not been reported on a balance sheet yet (if applicable).

Prepaid Expenses

Prepayments can be considered a current asset, even though they have no intrinsic value. When you pay for services or products in advance of receiving them, that payment is a prepaid expense. Once the service or product is provided to your business, it’s no longer a prepaid expense but instead becomes an expense.

This means that prepayments are on your balance sheet only long enough to cover the cost of the service or product you receive later on.

For example, if you make an advance payment for six months’ worth of website hosting fees, those fees are listed as prepaid expenses until each month has passed and the hosting company provides its services to your business.

At that point, these fees are removed from “prepaid” and added to “expenses” for six months until the start date of your next annual contract comes around again. Assets stay on your books permanently unless you sell them or write them off as worthless.

Other Liquid Assets

The purpose of this section is to think about the other liquid assets that your business has. These are things that, if you needed them to be cash, they can be converted into cash rather easily. You’ll want to add these up and record their total amount.

Examples include financial investments like stocks and money market funds, and even precious metals.

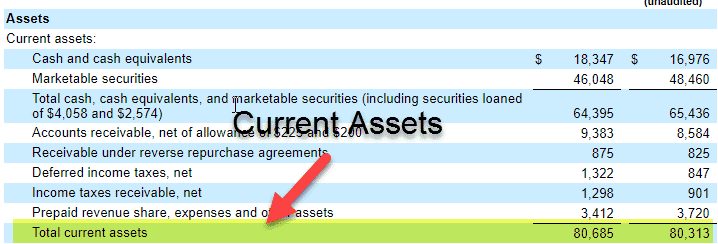

Examples of Current Assets on a Balance Sheet

Current assets are the most liquid of all assets found on a business’s balance sheet. You’ll see all the assets we mentioned above included in this section of the balance sheet.

Current assets are important for two reasons. First, they help a company meet its short-term obligations. Current liabilities are a company’s short-term financial obligations that are due within one year or within a normal operating cycle.

The second reason current assets are important is that they can affect a company’s working capital ratio and working capital.

How to Calculate Current Assets

You calculate current assets by adding up all the types of assets a company owns that can be converted into cash within one year.

Source: Wall Street Mojo

Here is the current asset formula:

Current Assets = Cash + Accounts Receivable (AR) + Inventory + Prepaid Expenses

1. Calculate Current Assets

Current assets are the resources a business owns that can be converted into cash within one year, or less. To calculate it, find the sum total of the following:

Cash and cash equivalents

Short-term investments

Accounts receivable (money owed from customers)

Inventories (raw material, work in progress, or finished goods)

Prepaid expenses

2. Calculate Current Liabilities

Next, you’ll calculate your company’s current liabilities. Current liabilities are debts that are due within a year. These can include payroll taxes, accounts payable, short-term loans, and rent.

Simply add up all of the short-term debts to see the total amount, which will provide your current liabilities figure.

3. Total Current Assets with Current Liabilities

To calculate your total current assets, you need to subtract the total of your current liabilities from the total of your current assets. This number represents your business’s net value (before taxes and interest) on any given day—also known as its book value or shareholders’ equity.

If this number is positive, then congratulations! Your company has a lot of working capital to work with in the coming year.

A good way to think about it is that this is money you have in the bank right now that could be used to cover any expenses that may come along in the next year—and hopefully go toward making more money for the business further down the line.

Current Ratio Formula

The current ratio, also known as the current asset ratio, measures the ability of a small business to pay its short-term debts and other financial obligations through its short-term assets. It is a liquidity ratio.

A high current ratio indicates that the company has sufficient assets and cash flow to pay its current liabilities in full. A low current ratio indicates that a company has difficulty paying its short-term liabilities when they come due.

The formula for the current ratio is:

Current Ratio = Current Assets / Current Liabilities

Quick Ratio Formula

The quick ratio formula, also known as the acid-test ratio, provides a representation of your company’s ability to meet its short-term obligations. It is a more accurate indicator of liquidity, because it takes the inventory into account.

The quick ratio is important to creditors and investors who want to predict your company’s ability to pay debts or fulfill contracts within one year.

You can calculate the quick ratio using this formula:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Net Working Capital Formula

Net working capital is what a business’s current assets are worth when its current liabilities are subtracted.

The calculation for finding net working capital is relatively simple. You take the value of all of your company’s current assets (including cash) and subtract the value of all of its current liabilities.

This gives you a picture of how much money you have left over to invest in opportunities that will help increase your business’s value as well as its ability to grow and expand in the years ahead.

Net Working Capital = Current Assets – Current Liabilities

How to Increase Current Assets

If your business is struggling, you have options. You can increase your current assets by using a combination of the following techniques:

Liquidating available assets: If you’re struggling to make payments, it’s time to sell off some of your most liquid assets. Liquidity means how easy it is for an asset to be converted into cash. Stocks and bonds, for example, are highly liquid since they are easily convertible into cash. A car, on the other hand, is not a non-current asset and not very liquid, making it difficult to convert into cash quickly.

Collecting accounts receivable: If you’ve already sold things on credit and haven’t yet gotten paid for them, then you should use that money to pay any outstanding bills.

Selling short-term investments: Another source of quick capital is selling off your short-term investments. Short-term investments include stocks and bonds that have a maturity of less than a year.

When looking at what items to sell first, it’s important to remember that the goal is not only to raise capital but also to keep your business afloat in the long run by selling off non-essential assets while retaining the essential ones, like your workforce.

Excel in Your Business and Maintain Valuable Assets with Signpost

It is no secret that customer reviews are one of the most valuable assets in any company. However, many businesses don’t take enough time to manage them properly. This is a mistake.

Reviews can be extremely valuable in helping potential customers decide whether they should buy your product or service. Like current assets, they are also great indicators for how well your business is doing. By managing reviews, you can improve your overall customer satisfaction and experience, which will result in more positive reviews and more happy customers.

By using Signpost’s marketing campaign tools and review generation platform, you can generate new clients and turn those leads into lifetime customers.

Start increasing the value of your business with us today!

If you need review management software for your business without the headache, Signpost is a cost-effective solution. Request a demo today.