Why You Need to be Keeping Track of Payments for Your Business

Cash flow is an area of business management that keeps small business owners up at night. And for good reason!

Cash is the lifeblood for any business. The movement of money in and out of your daily operations will impact every aspect of your business. Whether you’re a local plumber that needs to restock on tools and supplies or an electrician in need of fuel to visit a customer, cash is essential.

Did you know that 66% of small business owners have said that one of the greatest challenges to their business’s cash flow is the amount of time it takes to receive payments? In fact, for most businesses, one of the biggest challenges is getting paid at all.

Now, depending on your business model, a little waiting may be acceptable, but to know whether or not this can hinder your business (or to avoid this issue completely), you must track your payments.

In this article, we will review many payment tracking options that you can leverage to better manage your cash flow and streamline your payment processes. These options include:

Microsoft Office - Excel

Excel is the go-to software for most business owners. This is due to its simplicity and global usage.

This popular spreadsheet software developed by Microsoft Office has several templates to choose from that businesses can use to manage their internal records, including their finances.

Payment tracking templates is one of them.

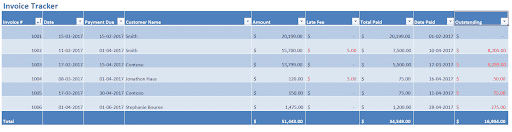

Excel provides options to fill in the invoice number, date, the payment date, customer name, and further details on the sums of money involved.

This sample Excel template is one among many offered on the platform and can be downloaded here.

The pros?

There is a wide variety of pre-made Excel spreadsheet templates online that can be used for your payment tracking. Some are made by Microsoft, others are designed and downloadable for free by other platforms. Here’s an example of 12 free payment templates. Find one that’s best suited for your business and its unique needs.

As a lot of people use these templates, you have a go-to community you can speak to if you have any questions. There are plenty of Microsoft support services and public forums out there.

The templates are highly editable, and you can tweak them to your liking on Excel. Some people even use Excel for their personal finances.

The cons?

Any updates made to the template are not saved automatically. You would have to search online on your own to find a recent version or update it yourself.

You can only share or work off one version of the bill tracker, making it more difficult to collaborate with your team. Multiple copies may have to be created, with varying data on each.

Think Microsoft is the best payment tracking option for your business? You can buy Microsoft Excel here.

UNLOCK THE TOP 5 WAYS TO GROW YOUR BUSINESS

Just give us your email address and we’ll tell you the top 5 ways to grow your business in 2022!

Google Sheets

Google Sheets rules out the disadvantages of Microsoft Excel and can be a lot more convenient to business owners on the go.

For starters, it’s absolutely free.

Like Excel, there are also several templates you can find online that are optimized for usage on Google Sheets. Additionally, you can always download a template for Excel and transfer or import/upload it into Sheets. This option might require some small tweaks to formatting, however.

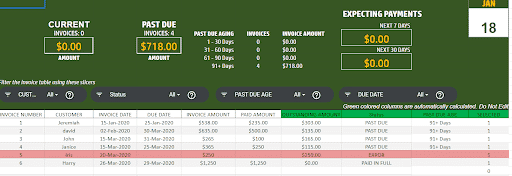

Here’s an example of one you can use:

The pros?

Google Sheets makes collaboration easy. You can make live updates, multiple users can be on the sheet at the same time, and you can even chat on the side while using it to make sure everyone is on the same page.

You get access to detailed revision history and can easily restore a previous version if you so wish.

Access settings are easy to change. Want to give full visibility to upper management, but restrict their editing access? Google Sheets provides a wide range of accessibility settings that the owner of the document can change at any time.

The cons?

There is always a margin for human error that must be accounted for. While working live, team members might make mistakes and update the sheet incorrectly. While this can be fixed, it’s more work in revision.

The more collaborators there are simultaneously on the sheet, the more lag you can expect in updating and saving your Sheets.

To start a Google Sheet, all you need is a Google Drive account! These are completely free and only require a Google email (Gmail) to get started.

QuickBooks

QuickBooks is a premium accounting software used by many small businesses. Its functions include invoice payment processing and tracking, and even payroll software.

Unlike MS Excel and Google Sheets, QuickBooks’ software is specifically designed for payment solutions and tracking. They offer online invoicing, professional invoice templates, recurring invoice systems, and more.

QuickBooks’ pricing differs and is based on a package system, with the lowest starting at $12.50/month and going up to $75/month for the advanced package. They also have add-ons at specific rates if you want a more customized experience.

The pros?

As it’s specialist software, it can provide very detailed reports you can use to keep track of metrics. It adds more value to your business’s finance function as a whole.

Payroll automation will also make your life easier. It takes into account other aspects that a generalized solution like MS Excel and Sheets might not consider.

The cons?

It’s the most expensive of the three, with recurring monthly payments.

There may be syncing and integration issues as it’s a whole new software/system. It will require more onboarding time to get familiar with the software.

Want to learn more about QuickBooks as a payment tracking option? Check out their packages here.

Want a DIY Solution for Your Business’s Payment Tracking?

If none of the above options is the right fit for your business, you also have the choice to create your own payment tracking solution. This might mean creating a template of your own from scratch on a platform of your choosing.

Some fields to consider including in your custom templates are:

Invoice number

Invoice creation date

Name of the customer and/or service

Customer contact details

Method of payment (cash, credit card, etc.)

Due date

Invoice amount

Amount paid/amount due

Status

Past due

The pros?

You retain complete control over the process. You have the liberty to specify the fields you want to include and customize it to your heart’s content.

You are free to use any file type or platform you want.

The cons?

It can be more time-consuming to create your template.

There may be some loose ends or aspects you have failed to consider. It might not have the “clean finish” that you get from a paid/professional solution.

Things to Consider When Tracking Payments

When a business tracks payments, it must do it the right way. Otherwise, a business can risk losing the data, miscommunicate with clients and customers, or build up debt.

Here are some best practices to keep on your radar as you navigate your payment management process:

Ensure that you have a backup system in place. You always run the risk of technology failure and the risk of losing payment files and invoices. Build a robust backup system that can include both digital copies (on the cloud or hard-drives) and physical copies (printable and filed).

Create a ledger. Your business will benefit from an organized system. If you don’t have one already, build a detailed filing system to keep track of your payments.

Password protect sensitive information. This falls in line with digital safety and security protocol so no one unwittingly tampers with the wrong files or has access to sensitive information.

Issue receipts. Make sure your customer is informed and kept up-to-date on the status of payments. They should have receipts for their records, as well. If any payment issues arise, a receipt will help reconcile any discrepancies and potentially solve the issue.

We’ll Support Your Payment Tracking

Your payment systems play an integral role in building your business.

In order to ensure proper budgeting, build profits, and serve your customers with better payment terms, your business must have a payment tracker in place to monitor the money coming into your business and plan well financially.

If not alone, you can always opt for help through an expert service like ours.

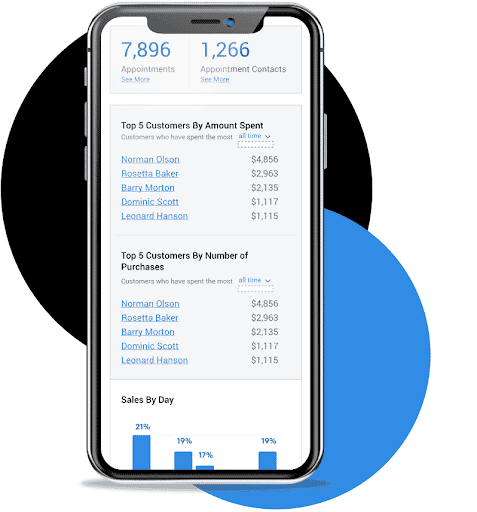

Signpost offers an integrated payment solution, specifically built for service-based businesses.

Optimize your payment processes by capturing the full, 360-degree picture of your customers and get paid on time. Every time. Get support from our dedicated team and make payment tracking easy!

Get started here today.

You understand payment tracking. Now what?

Learn the top 5 ways to grow your business in today’s day and age! Download our free guide.